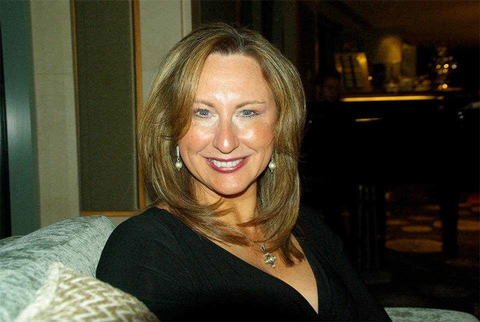

Travel agency acquisitions are on the rise, with the latest example being a merger between two of Minnesota’s oldest travel agencies that are looking to grow further by acquiring additional businesses. Travel Agent spoke with Sandy Anderson, president of travel agency operations for the newly combined Allied Continental Holdings, on how agents looking to sell their business can navigate the evolving landscape.

“There are some acquisitions happening just to buy volume because this is a volume world,” Anderson says. “I want my baby, who’s growing up, to keep flourishing.”

Anderson founded Riverdale Travel, which is based in Coon Rapids, MN, in 1986 as a mom- and pop-shop that grew organically over the years. This week the agency announced a merger with Minneapolis-based Schilling Travel, in which Schilling will acquire Riverdale for an undisclosed sum, organizing under parent company Allied Continental Holdings. Riverdale is part of Signature Travel Network, while Schilling is part of Travel Leaders Network; eventually, the plan is for the new company to be entirely a part of Signature, Anderson says. Together the two agencies have annual sales of over $20 million, and plans call for the combined company to continue growing with the acquisition of further travel agencies throughout the Midwest.

Finding a partner who looks beyond booking volume to her whole business was important to the acquisition, Anderson says. “When I went to market, I had great volume and I had people who wanted to buy my volume, but I wanted them to see who we were,” she says. “I wanted them to see that, yeah, that person does spend $100,000 a year with me, but it’s also about what our value statement is and what we can give to the customer’s trip experience.”

A growing increase in travel agent retirements – a point raised at the recent Travel Leaders Network EDGE Conference – is another major factor driving agency consolidation.

“This is kind of a succession plan for me,” Anderson says. “I’m not quite ready to retire, but I want to make sure everything that’s out there is accessible to my agency, and you sometimes have to consolidate to have that access to that volume.” Getting access to the latest technology through consortia relationships was another big factor, Anderson noted.

“I was a Carlson Wagonlit Travel / Travel Leaders franchise for a very long time, and a year ago I changed to Signature,” Anderson said. “They both offer good technology, and they both give good deliverables for agents to use.”

One pitfall? Agencies that rely to much on the owner’s personal book of sales.

“If you’re an owner and you’re booking more than 50 percent of an agency’s volume and you’re ready to get out, that’s not really a positive thing in a buyer’s mind,” Anderson says. “I think before you get to the point of walking away you have to get your agency to a value that someone would want…It’s not like throwing the towel in, it’s like giving your baby more of a future.”

The supplier space has also seen a great deal of consolidation recent, such as with the recent merger between Apple Leisure Group and The Mark Travel Corporation. But when asked Anderson didn’t see that as much of a factor behind the consolidation of travel agencies for her.

“Those are both great vendors of mine,” Anderson says. “I think they’re taking the best of both of their companies.”

For travel agents who are thinking about selling their agency or retiring, Anderson recommends not to be intimidated by it, and to explore their options.

“Even if you don’t know you’re going to, even in five years, see how you value your agency,” Anderson said. “At the end of the day we all have to have a personal life – what does that look like?”

Related Stories

Two Minnesota Travel Agencies Merge, Seek Further Acquisitions

Iberostar Exec Talks Where Mexico All-Inclusives Are Headed Next

After Travel Ban Decision, ASTA Calls for Welcoming Message on U.S. Travel